April 9, 2019

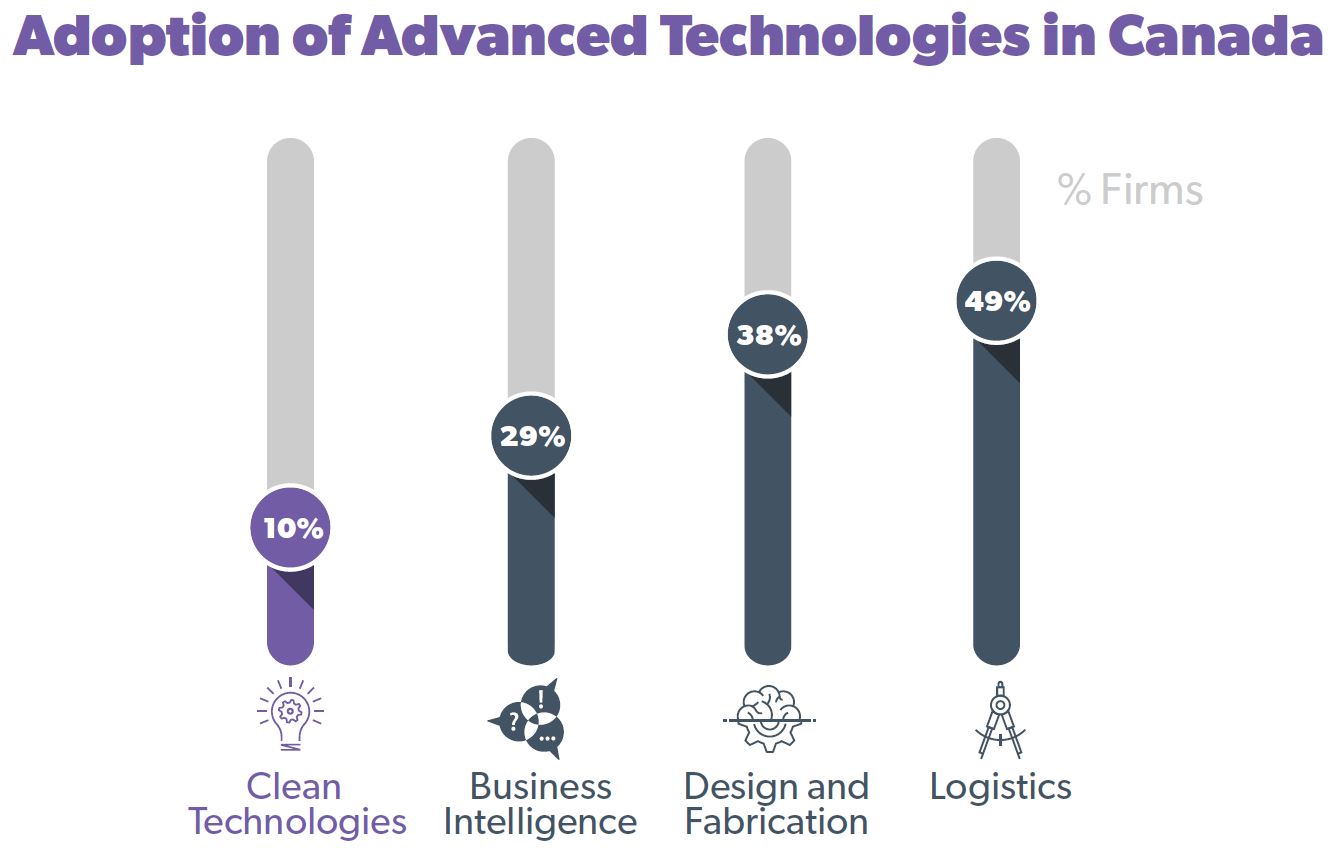

While Canada has a promising cadre of cleantech firms poised for growth, lack of financing and slow adoption remain major barriers to growth. There are fiscal incentives that could address these barriers, as explored in our new duo of policy briefs focussed on Tax Incentives for Clean Growth.

The recent federal budget was relatively light on clean growth measures, particularly in comparison to recent years which saw significant investments in clean growth. Fiscal tools can provide powerful incentives to drive clean growth, both as carrots and sticks. However recent tax policy changes in the US have reduced Canada’s historical corporate tax advantage, threatening to pull investment in the development and adoption of clean technologies south of the border.

Accelerating innovation and adoption of cleaner technologies requires a holistic policy approach that includes a mix of push, pull, grow, and strengthen policies. In particular, pull policies play an important role in stimulating demand for more environmental-friendly technologies. These can take the form of stringent, flexible, and predictable environmental regulations such as pollution pricing. However, environmental regulations can also add to the cost of doing business, at least in the short-term. Therefore, there is a need to balance ambitious environmental policies (sticks) with targeted incentives (carrots). These incentives can help Canadian businesses accelerate the development and adoption of clean technologies across the economy and boost business competitiveness to compete in a cleaner, more innovative global economy.

In order to address concerns over competitiveness, and in response to recommendations from the federal Economic Sector Strategy Tables, the federal government’s 2018 Fall Economic Statement announced an increase in the eligible write-off for investments, known as accelerated capital cost allowance (ACCA), in clean energy and manufacturing equipment to 100% in the first year. However, the clean energy equipment currently included for 100% ACCA is limited to 19 specific clean energy technologies. Expanding the scope of technologies to include those that improve energy and water efficiency or reduce material waste, for example, could help support the sustainability of Canadian businesses outside of the clean energy sector. This could be done by expanding the list of specified eligible technologies (as has been done in the U.K. and the Netherlands) or using a performance standard to determine eligibility. Expanding the use of ACCA for clean technologies is a two-pronged opportunity for Canada: first, to bring down business-related taxes to support competitiveness in light of recent tax policy changes in the US; and second, to do so in a targeted way that helps advance Canada’s clean growth, climate, and innovation agendas.

Another critical challenge to accelerating clean growth in Canada is financing the scale-up of emerging clean technologies. Equity investments, through venture capital (VC) and other means, are an important source of financing for emerging clean tech firms. However, while Canada has a growing pool of investment capital, the amount available is significantly lower than in the US, relative to the size of the two economies. There are fiscal incentives that could be used to help address the financing gap:

For more on how these tax incentives could work, check out our policy brief series on Tax Incentives for Clean Growth:

Canada has enormous potential to be a global leader in the clean economy. While the US is trying to resurrect the coal industry, Canada can strategically incentivize investment in the economy of the 21st century and be ready to capture a share of the $26 trillion global market opportunity for the countries and companies that are able to find innovative, low-carbon ways of doing business. Targeted tax incentives can be the carrots that help address existing barriers and jump-start Canada’s clean innovation ecosystem to drive clean growth.