November 16, 2017

By Mike Wilson

Today, Smart Prosperity Institute and the Climate Bonds Initiative have released the sixth annual Green Bonds Canada Report, which is a special supplement to the Bonds and Climate Change: The State of the Market in 2017 global report. Every year, we collaborate to track the highlights from the current year, the emerging trends, and the opportunities ahead for green bonds in Canada. We are also happy to announce that for the first time, the report is available in both English and French.

In time for COP23, green finance just hit a brand new milestone with global green bond issuance in 2017 reaching $100 billion (surpassing the previous 2016 record of USD $83 billion). This rapid green bond growth is an encouraging sign. Green bonds–just like regular bonds except that 100% of the proceeds from the bond sale are used to support environmental projects –are a key tool to help finance the transition to a low-carbon economy and to meet global, national and local sustainability goals. In the words of Former UN Climate Chief, Christiana Figueres, “passing $100bn in green bond issuance shows we are moving capital flows in the right direction.”

Canada has not lagged behind this global growth. Although we only account for nearly 4% of global green bond issuance, our report shows that 2017 has been Canada’s biggest year yet. We hope that this momentum only accelerates further growth in the coming years. The Canadian economy will require $3.4 trillion in new investments from now until 2050 to stay on a path consistent with its Paris commitment target (according to a recent Conference Board of Canada report), and green bonds can be instrumental in helping to steer financial sector capital toward investments needed to drive deep emission cuts.

Here are some of the highlights from this year’s Green Bonds Canada Report:

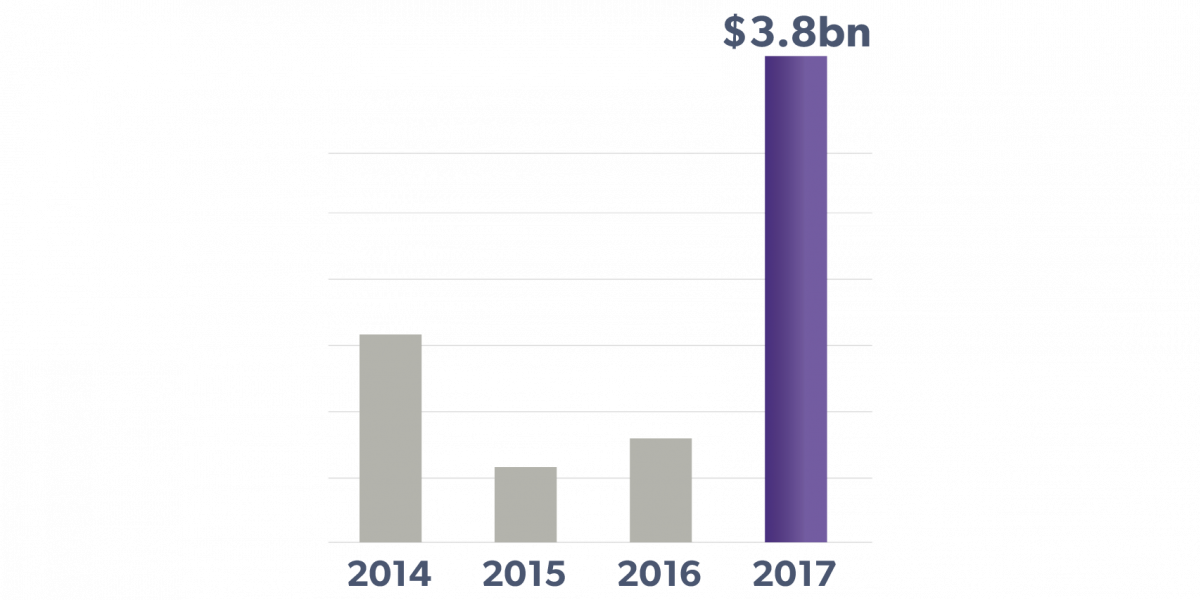

1) Green bond issuance in 2017 exceeded that of all other years combined (with 2017 issuance to date amounting to over C$3.8 billion), but opportunity for growth remains as demand continues to outstrip supply. This strong demand is driven in large part by investors with green mandates - although green bonds’ identical structure to regular bonds makes them equally attractive to more traditional investors.

2) Provincial entities have spurred issuance with Ontario and Quebec leading the way in 2017. These two provinces have expressed interest in continuing to access the green bond market to finance climate mitigation and adaptation activities, and position themselves at the forefront of financing trends to promote new markets.

3) The City of Ottawa became the first municipality in Canada to issue a green bond. The city raised $102 million that will be used to finance light rail transit. Although Ottawa’s issuance is a first for Canada, given the long list of low-carbon and climate-resilient infrastructure projects required across Canadian communities in the coming years, it will probably not be the last.

4) Other important issuers in 2017 include Export Development Canada, which is Canada’s first and most frequent issuer (together with Ontario); TD Bank, which issued the largest Canadian green bond to date; and CoPower, which continues to offer the only Canadian green bond available to individual investors.

5) While many other countries including France, Poland, and Fiji have issued sovereign green bonds, Canada has yet to do so. Sovereign green bonds could help harness much needed private capital as public funds alone will be insufficient to achieve Canada’s climate goals. In addition, a sovereign green bond could help boost the nascent green bond market by raising the profile of green bonds with other potential issuers such as corporates and commercial banks.

6) There are a number of actions that governments can do to help accelerate the growth of the green bond market in Canada. Government issuance is a powerful one, but other policy levers include supporting market standards and providing tax incentives, among others.

Want to know more? Click here to view our report. Click here to view our past annual reports.