November 17, 2017

Bonds and Climate Change 2017: The State of the Market Canada, marks the sixth annual stocktake of green bonds and green finance in Canada, produced in partnership with the Climate Bonds Initiative.

The State of the Market Canada edition results from a longstanding joint partnership between the two organisations and is a special supplement to the flagship Bonds and Climate Change: The State of the Market global report.

The Canada edition marks specific highlights from the current year, emerging trends, and identifies specific opportunities for green bond market development.

Key highlights from the 2017 report:

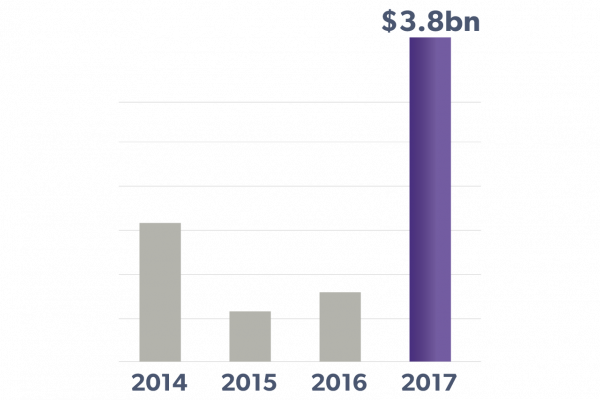

- Green bond issuance in 2017 has exceeded that of all other years combined (C$3.8bn) but an opportunity for growth remains as demand continues to outstrip supply.

- Canada ranks 10th in the world as a source of labelled green bond issuance to date, and 5th in unlabelled climate-aligned bond issuance.

- Provincial entities have spurred issuance, with Ontario and Quebec leading the way in 2017.

- Other major Canadian issuers include Export Development Canada (EDC), Toronto Dominion (TD) Bank and CoPower, and more recently the City of Ottawa, which issued the first municipal green bond out of Canada.

- Ambitious climate commitments and policy have been put in place to transition to a low-carbon economy. A growing Canadian green bonds market can be instrumental in steering private sector and international capital flows to finance this transition.

- As a G7, G20 & OECD nation there is an opportunity in Canada for the federal government to demonstrate leadership in green finance by issuing a sovereign green bond, paving the way for others to follow, particularly corporate issuers.

- Other actions include supporting market standards, exploring the use of tax incentives and facilitating the formation of broad-based expert groups to examine green finance directions.

- Canadian banks, pension funds, and institutional investors need to play a more active role in developing green financial instruments and the domestic green bond market.