June 23, 2025

By Sara M. Bechtold with Dr. Colleen Kaiser

Climate resilience and competitiveness in today’s global economy depend on how well companies plan for a low-carbon future. Despite current regulatory uncertainty, political instability and climate volatility, decarbonization is no longer a choice or a distant aspiration. It’s business risk, and companies must manage that risk for their investors.

Climate ambition pledges are everywhere, but the process of planning how companies will meet them is not. In Canada, bold climate targets are running up against regulatory gaps and wavering financial commitments. The result? A growing credibility gap that could stall progress and shake investor confidence. Climate-related transition plans and planning are important elements to close this gap.

In Canada and around the world, climate-related transition plans are increasingly seen as a foundational piece of the climate policy and finance puzzle. But what exactly are they, how do they fit into broader climate governance, and where does Canada stand compared to other parts of the world?

While a climate pledge sets a company’s destination to low-carbon, a climate-related transition plan maps its route, complete with timelines, investment strategies, risk assessments and governance structures. The plan is the result of the transition planning process. It’s a detailed blueprint that outlines how an organization—be it a government, company or financial institution—intends to reduce its emissions in line with science-based targets, even as global conditions continue to shift.

They are a crucial planning tool for companies and investors, giving them the data they need to make smart and sustainable investment decisions. This means attracting investments and funding projects that are sustainable and competitive.

Credible climate-related transition plans are time-bound, transparent and part of core business or policy strategies. My PhD research focuses on corporate climate-related disclosures, which include transition plans. I study how—when informed by emerging best practices—these disclosures help organizations prepare and build information credibility for a decarbonizing world. Transition plans identify what actions will be taken and when, and how success will be measured. In short, they shift the conversation from intentions to implementation. Done well, transition plans provide a clear and consistent signal to stakeholders—from investors to consumers—of an organization’s commitment to strategic climate action and its ability to deliver on it.

In my research, I’ve seen how companies struggle to move from high-level goals to practical steps. Transition plans can provide a roadmap and accountability structure that’s often missing. But it’s not just the plans that are helpful. The process of planning also ensures companies have the right data and risk-mitigation strategies to steer toward a low-carbon future. There’s growing recognition that credible transition plans and transition planning are critical to:

Without robust transition plans and planning, companies’ low-carbon ambitions risk being perceived as greenwashing or a distraction from real progress.

Climate-smart is business-smart. Climate risks—physical (floods, wildfires and supply-chain disruptions) and transitional (policy changes, shifting consumer preferences)—are financial risks. Without information about these risks, investors and other stakeholders may misjudge a company’s true financial position and expose themselves and the market to avoidable shocks. Companies that anticipate and manage these risks—and communicate their plan to address them—are more stable, insurable and attractive to investors and consumers.

Corporate benefits

Climate-related transition plans can help companies attract capital, reduce costs, lower insurance premiums and protect brand reputation. Transition planning also supports better risk management and business resilience by identifying and addressing climate-related risks.

Internal, process-based benefits include:

Other stakeholder benefits

Externally, credible transition plans deliver clear, actionable insights into sustainable business activity and drive collaboration and innovation across value chains. In particular:

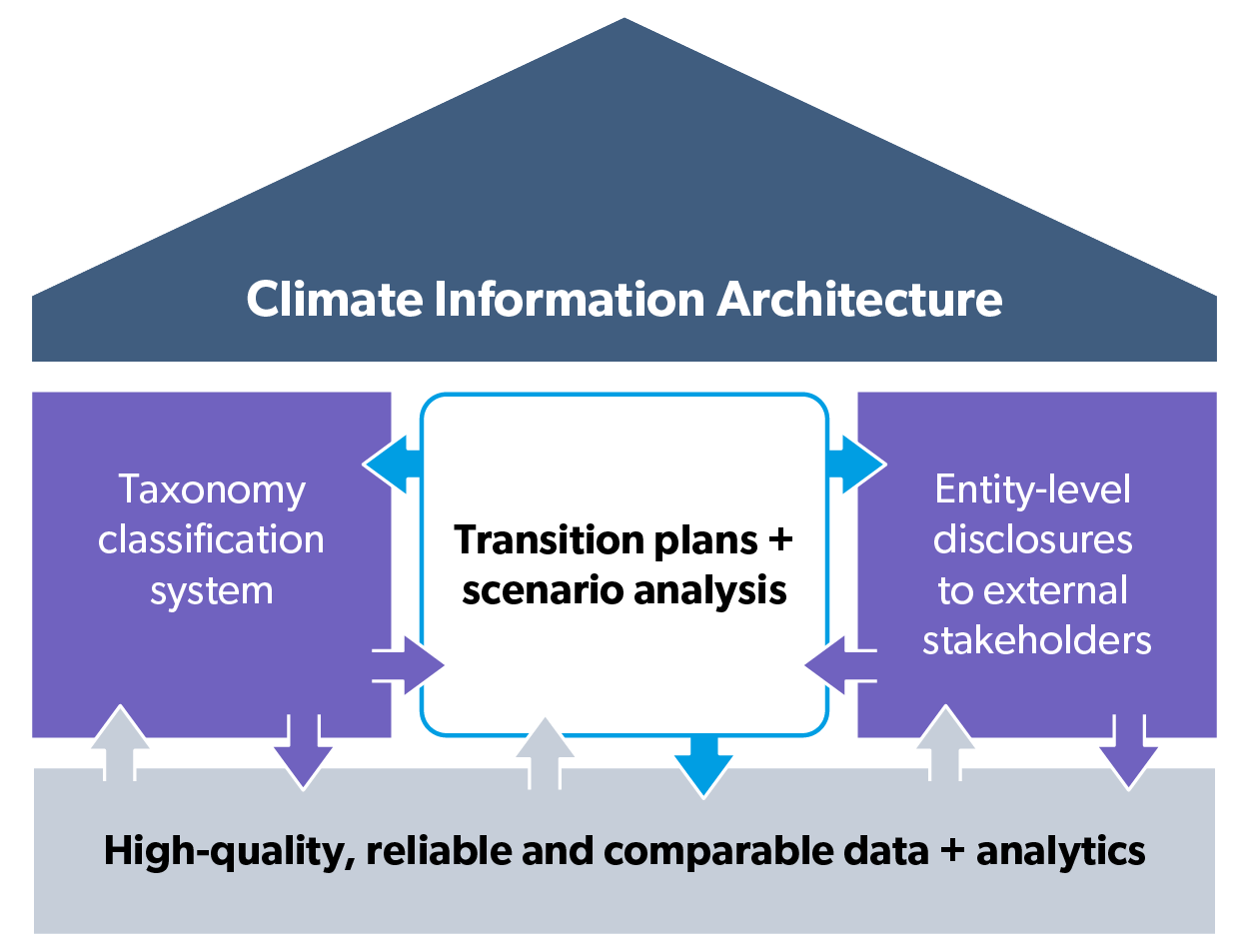

Climate-related transition plans and planning are one of several core components in the emerging climate information architecture—the data, standards and tools that support climate-informed decision-making across the economy. These building blocks work together to support the core goal of transition action, mobilizing capital to fund and advance a low-carbon transition. In the architecture, transition plans act as a kind of linchpin between elements. Without credible transition plans, the architecture risks falling apart and companies struggle to decarbonize.

Other building blocks of the climate information architecture include:

Source: Islam, A. Smart Prosperity Institute. 2025.

Canada’s adoption of transition plans has lagged, but we’ve made important strides. More than half of Climate Engagement Canada’s 42 companies on the Toronto Stock Exchange put detailed transition plans in place last year. The federal government legislated a net-zero by 2050 goal, introduced the Net-Zero Emissions Accountability Act and developed a 2030 Emissions Reduction Plan with sector-by-sector targets. Most recently, some of Canada’s most well-known sustainable-finance experts launched an initiative called Business Future Pathways to bolster companies’ transition plans and help them access more global capital.

Progress has been slowed down by challenges around regulatory uncertainty, data availability, internal capacity and limited market awareness. Still, Canada must do more to ensure transition plans are credible—clearly time-bound, transparent and integrated into core strategies—to move from ambition to action and build lasting confidence among stakeholders.

Transition planning isn’t about adding new burdens. It’s about integrating climate strategy into existing operations and governance. But aligning standards across federal and provincial regulators remains a challenge. New guidance published today by the IFRS Foundation aims to help entities provide high-quality information about their climate-related transition plans - reinforcing the importance of credibility. Stay tuned for an upcoming work by my colleague Anik Islam on how aligning sustainable finance frameworks can help drive Canada’s economic transition.

As other countries mandate standardized transition plans, Canada must determine how best to encourage their development, support credible implementation and clarify expectations for their use in investment and regulatory decision-making.

Canada’s global competitiveness, investor confidence and climate credibility may all depend on how quickly and effectively we can move from pledges to plans. Below are recommendations for enhancing climate-related transition plans in Canada:

To unlock the full potential of transition planning, Canada will need to:

Canada’s global competitiveness, investor confidence and climate credibility may all depend on how quickly and effectively we can move from pledges to plans.

Transition plans are more than just technical documents; they are a test of our seriousness. As governments and companies make climate commitments, the pressure is on to back those commitments with credible, transparent and actionable plans.

Canada has the tools and the expertise. What’s needed now is coordination, accountability, leadership and ambition. The low-carbon transition is not a distant goal—it’s a daily process of change. Transition plans are how we manage that change, track it and accelerate it.

Our ongoing transition plan research

I recently led a study on how Canadian companies are disclosing climate-related plans for the future—a key area that hasn’t been closely examined even as new reporting rules are on the way. We’ll link to the study on our sustainable finance page once it’s published, so be sure to check back. We’ll also include a brief that we’re working on that lists key research questions we should be asking about how Canada can best integrate climate-related transition plans on its path to decarbonization.

Keep up to date on our latest developments by signing up for our monthly newsletter. Interested thinkers are also encouraged to reach out to Sara Bechtold at info@smartprosperity.ca.