This guest blog is based on the paper “BC’s Carbon Tax: Addressing Gender, Age, and Locational Impacts” written by Jessica Knowler (Simon Fraser University) as partial fulfilment of the requirements for the Degree of Master of Public Policy. This research project was supported by Smart Prosperity Institute's Economic and Environmental Policy Research Network (EEPRN).

May 14 2018

Guest post by Jessica Knowler

In October 2016, the Federal Government announced the 2018 implementation of a national carbon price floor of $10/tonne, rising by $10 each year to $50/tonne in 2022. If provinces and territories do not introduce a price on carbon, they will be subjected to the federal implementation of a benchmark (or price floor) of $10/tonne in 2018. The purpose of a carbon price is to reduce greenhouse (GHG) emissions that are contributing to climate change, by making it more expensive to produce and consume carbon-intensive goods, as well as stimulating investment in low-carbon alternatives.

Provinces are beginning to design and implement their own carbon pricing approaches to comply with the national benchmark, choosing between carbon taxes (e.g. Alberta), and cap-and-trade programs (e.g. Ontario, Quebec, Nova Scotia). Implementation of carbon pricing policies raises important questions about the unintended impact these policies may have on marginalized and vulnerable communities. While most carbon pricing regimes implemented in Canada are too recent to allow for evaluation of these impacts, British Columbia (BC)’s almost ten-year-old carbon tax presents us with a unique opportunity from which to draw real-world evidence.

The BC carbon tax has four major components:

My research focused on the structure and effectiveness of the tax credits that BC chose as the policy instruments to combat the regressive impacts of the tax. The tax impacts were forecast to disproportionately affect marginalized and vulnerable communities, especially those with low and fixed incomes that have a higher reliance on carbon-intensive goods (e.g. fossil fuels for heating and transportation). Marginalized or vulnerable residents are less likely to be able to switch to a different fuel source or complete a retrofit due to their job, income, and/or location. I focused specifically on women, youth, and rural dwellers and explored options to develop a carbon pricing scheme for BC that is redistributive and fair, whilst still reducing GHG emissions.

My analysis, based on available Statistics Canada data, found the following (detailed methods and results can be found in my capstone paper):

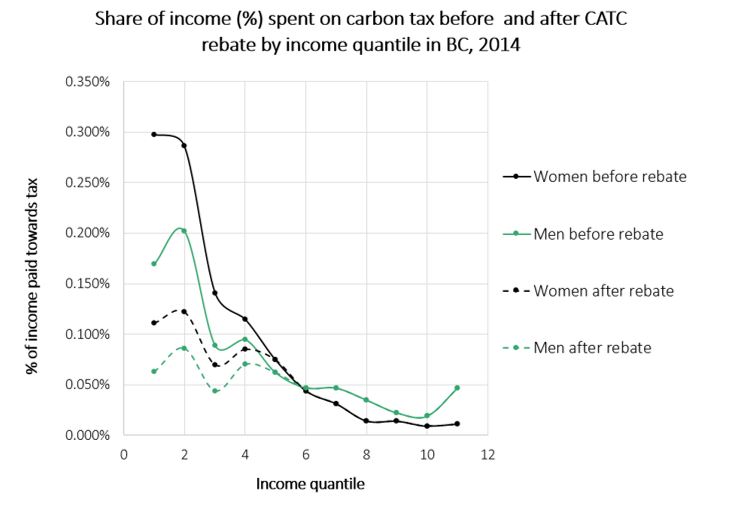

1) The carbon tax does create differential impacts based on gender, age, and between urban and rural locations, but by small amounts overall. For instance, the proportion of income paid towards carbon tax is 0.21% higher for BC women than BC men, due to income inequality. Rural dwellers who are not homeowners, including youth, are also disproportionately burdened by the tax by <1% when the carbon tax rate is $30/tonne.

2) The low-income Climate Action Tax Credit helps to offset most of the regressive impacts for the populations studied. For example, women only pay 0.04% more for carbon-intensive goods than men after the low-income tax credit is applied.

Thus, low-income credits appear to address the regressive impacts of BC’s carbon tax, at a rate of $30/tonne. But as the carbon tax rate rises to $50/tonne and higher, regressivity and inequities will need to be continually accounted for. Based on the data analyses and analysis of policy options for tax credits, my recommendations for BC include:

1) Enhancing the targeted refundable tax credits already in place, which includes

2) Collecting more disaggregated data so that the effects on marginalized and vulnerable populations can be better studied.

With the announcement of the federal price floor, carbon pricing is here to stay as a major tool for policymakers in combatting climate change. Equitable revenue recycling for marginalized or vulnerable populations ensures BC’s carbon tax works not only towards sustainability goals but also to mitigate inequities as carbon prices rise over time.