March 4, 2020

By Mike Moffatt

How can Budget 2020 help build a stronger, cleaner economy? This month SPI draws on the latest research to highlight four good bets for how Budget 2020 can launch us in the right direction. See all four bets here.

The federal government has a big opportunity to accelerate the development and adoption of low-carbon technologies in 2020. Here’s how they could do it...

The opportunity is a massive one; the Smart Prosperity Growing Clean report forecasts that the demand for low-carbon products will double through 2030. In Budget 2020, I’ll be looking for policies that help Canadians take advantage of this pent-up demand for low-carbon solutions. But before we try to predict which policies the government might adopt, first we need to understand the opportunity.

The report defines low-carbon technology as follows:

“Environmental and Clean Technology is defined as any process, product, or service that reduces environmental impacts. For the purpose of this analysis, we similarly define low-carbon technologies to ensure GHG reductions, with mapping to the Government of Canada’s Environmental and Clean Technology Products Economic Account.”

We can break the set of low-carbon technologies into five types:

The short answer: through economic modelling. Here’s the long answer, from the report:

“Economy-wide economic and energy modelling is used to stimulate a future where Canada scales-up climate and energy policy (current and developing) to achieve the 2030 target of a 30% reduction in GHG emissions compared to 2005 levels. In our scenario, the stringency of climate and energy policy is ratcheted-up to achieve total Canadian GHGs of 543 Mt in 2030. The remaining mitigation commitment (i.e. to reach 512 Mt) is met through 31 Mt of carbon credits from Quebec’s cap-and-trade market linked with California, as well as other internationally transferred mitigation outcomes.

In the analysis, we track private sector investment in fixed-non-residential capital and household capital expenditures to estimate investment, closely following the national accounting approach to estimating investment. Therefore, the estimates can be broadly compared against published statistical agency investment data. The Navius Research g-Tech model underpins the analysis.”

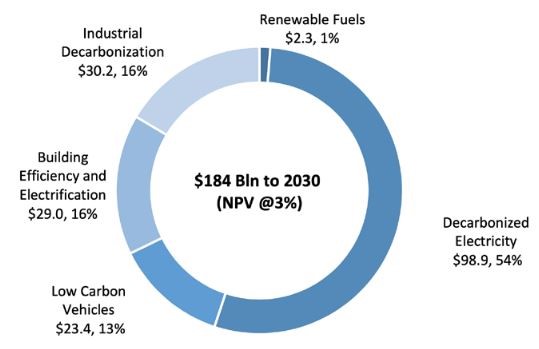

Of our five types of low-carbon technologies, the report forecasts that decarbonized electricity will experience over half of the cumulative investment dollars between 2020 and 2030:

While the report forecasts an increase in demand for these products, public policy (beyond carbon pricing) can play a role in accelerating investment. There are several reasons the federal government may adopt policies in Budget 2020 to accelerate this investment, including:

There are a basket of possible tools at the federal government’s disposal. Five broad themes of policy that appear promising include:

As for what the federal government will actually do, the first place to look is in trial balloons. Earlier this month, the Prime Minister suggested that write-offs are coming for off-road electric cars, an incentive for the adoption of low-carbon technologies. The other place to look is the Liberal election platform, which promised halving the corporate income tax rate for manufacturers of zero-emissions technologies. This helps cleantech start-ups and scale-ups attract capital, as investors will be able to retain a larger portion of profits in the future. Hopefully, we will see additional policies that touch on the rest of our five themes!