October 10, 2024

By Caelan Welch

Yesterday’s announcement made by the Honourable Chrystia Freeland, Deputy Prime Minister and Minister of Finance, brings Canada one step closer to creating a green and transition finance taxonomy. This announcement, made at the PRI in Person conference in Toronto, follows recommendations submitted by the Sustainable Finance Action Council (SFAC). It also builds on our contributions to advancing key pieces of Canada’s climate information architecture on taxonomies, disclosures and data. In addition, it coincides with a commitment made by the Government in the 2023 Fall Economic Statement and Budget 2024.

I’d like to cover some key questions about taxonomy to give you a better sense of what this announcement means, why it’s important, and where Canada stands on taxonomy development in comparison to our global peers.

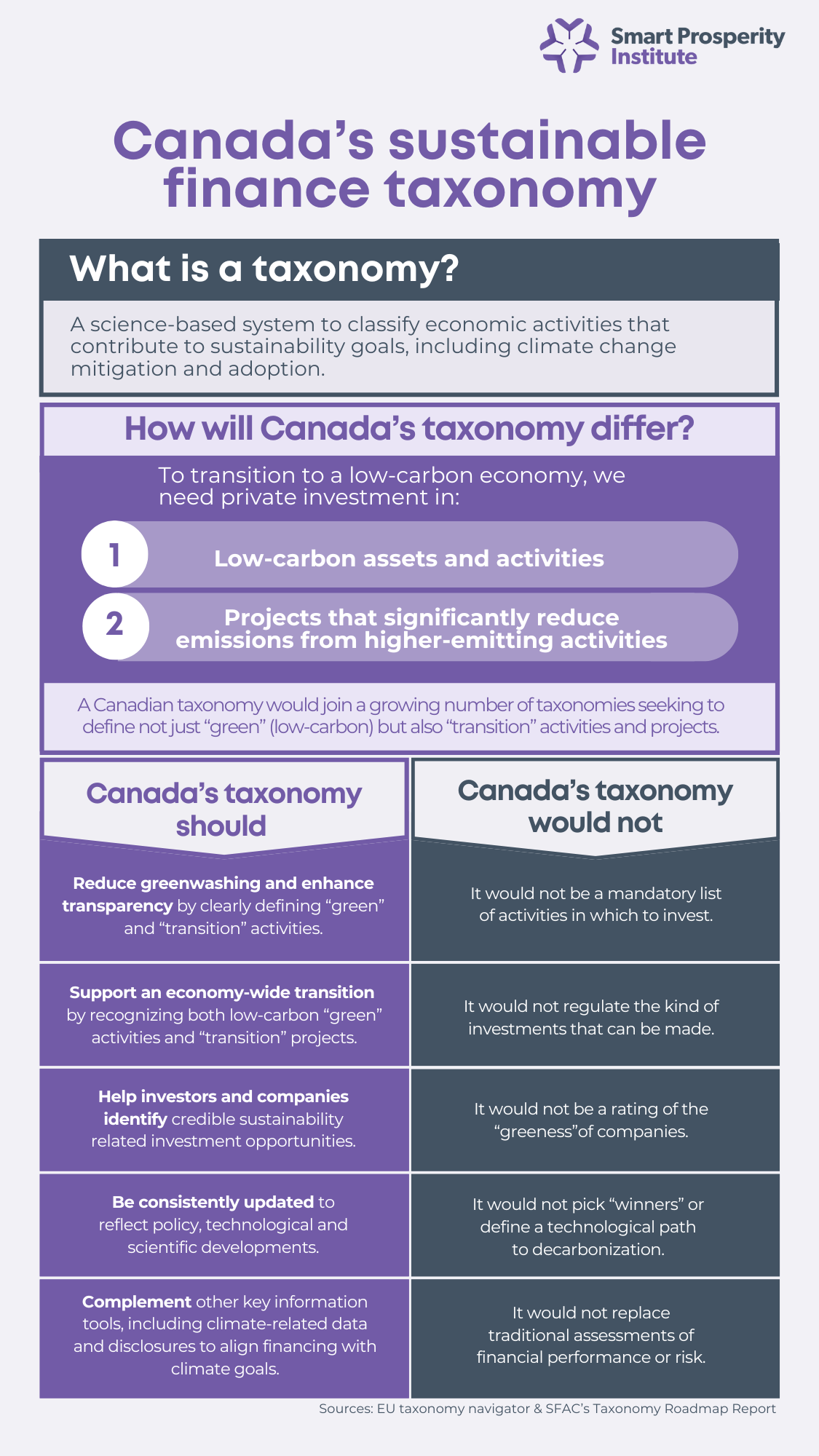

A taxonomy is a common language for something. In this case, that something is sustainable finance. A sustainable finance taxonomy is a system of classification used to identify activities in our economy that contribute to sustainability objectives such as green hydrogen or solar energy generation. By using a taxonomy and the criteria it outlines to define when an activity can be credibly considered “sustainable,” investors and companies can more easily decide whether an investment is sustainable or not.

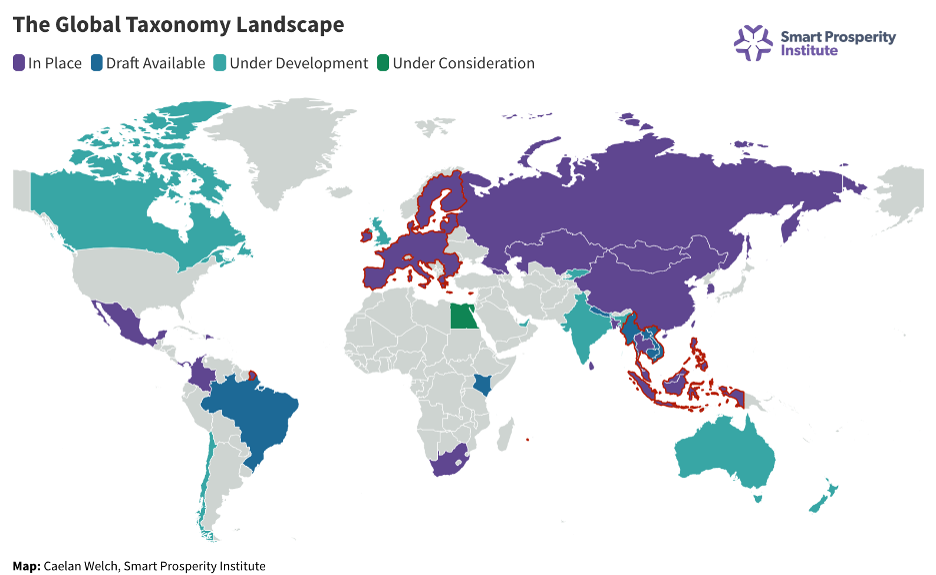

Over the last few years, taxonomies have gone from being an obscure informational tool to enjoying widespread adoption globally. As of 2024, around 40 national or regional taxonomies are now in place or under development.

Note: Red lines indicate regional taxonomy efforts in the European Union and the Association of Southeast Asian Nations (ASEAN). Several ASEAN countries are participating in the regional effort while also developing national taxonomies. Shading of ASEAN countries reflects national taxonomy status.

Given this, Canada is lagging behind on taxonomy development; however, that doesn’t mean we shouldn’t develop our own. In fact, it’s important that Canada moves forward to get a taxonomy in place sooner rather than later. National and regional taxonomies should reflect the economic context and sustainable development priorities of individual countries. This makes them helpful in mobilizing sustainable investments in areas of the economy that are critical to a country to achieving its sustainability goals.

Canada has a unique chance to shape the global conversation around taxonomies by addressing “transition” activities like converting steel production to be powered by electricity. Transition activities are those that help decarbonize high-emission industries, aligning them with the path to a 1.5°C target for climate change. Most current taxonomies focus on “green” activities that are already low or zero-carbon, like building a wind farm. However, Canada's economy includes high-emitting sectors that need to reduce emissions to achieve net zero by 2050. A Canadian taxonomy will include green and transition activities.

Canada's SFAC suggested a science-based approach to creating a taxonomy that defines green and transition activities. If designed well, a Canadian taxonomy that includes transition activities could serve as a global model for other countries.

The Government of Canada has outlined its expectations for the taxonomy’s development, which include:

Canada’s push towards a green and transition finance taxonomy marks a pivotal step in aligning the country's financial systems with its climate commitments. By creating a clear and credible framework to classify sustainable and transition activities, Canada can mobilize investments in sectors crucial to achieving net-zero emissions by 2050. This taxonomy will not only drive green projects like renewable energy but also support the transformation of high-emission industries, setting Canada apart globally. As other nations move swiftly with their taxonomies, Canada's commitment to including transition activities ensures it plays a key role in shaping the global sustainable finance landscape.

[i] https://www.canada.ca/content/dam/fin/publications/sfac-camfd/2022/09/2022-09-eng.pdf